How Avenue Living is Embracing Sustainable Finance

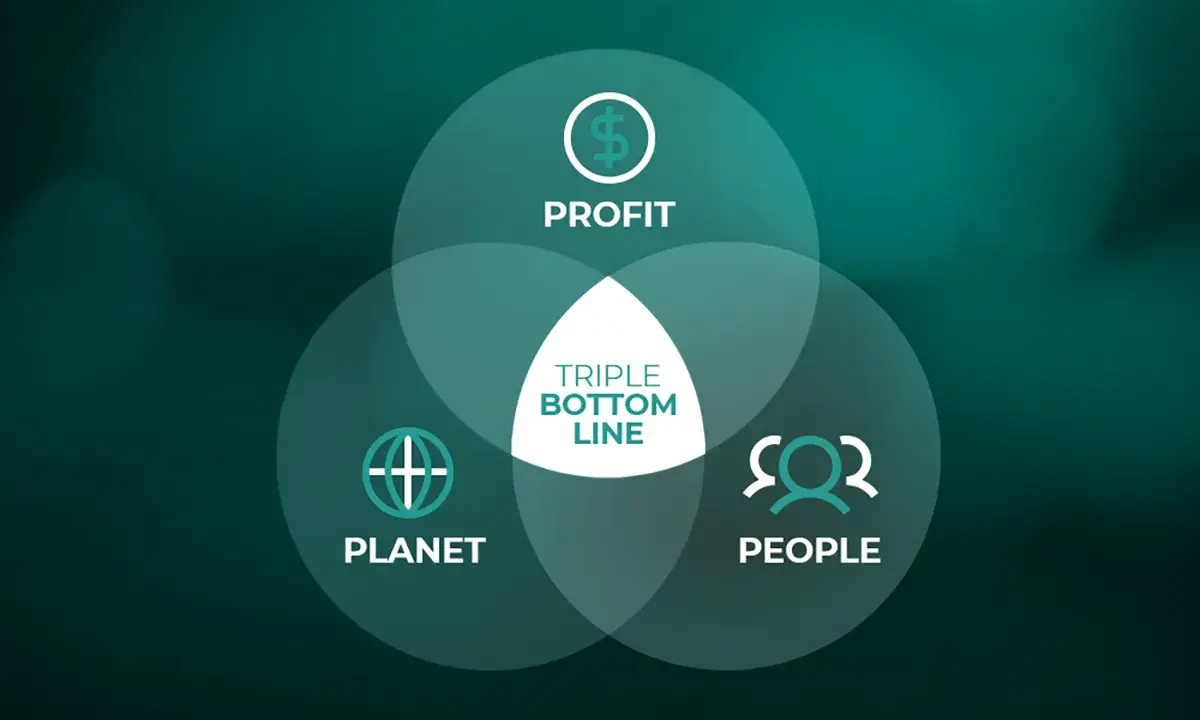

People, profit, planet. The “three P’s” are foundational elements of what’s known as the Triple Bottom Line approach, or “sustainable finance,” and it’s something Avenue Living has taken to heart.

The concept of a “triple bottom line” has been around since 1994, but it has gained real traction in the business world — and now the investment community — over the past few years. Sustainable finance means building environmental, social and government (ESG) considerations into all aspects of our investments. The philosophy goes beyond carbon footprint, a standard measure of environmental impact, to the ways organizations affect their communities and even their employees.

“The world is changing and making a transition to a green economy that maintains growth by continuing to develop low-carbon infrastructure,” says James Jung, Chief Executive Officer, Global Logistical Solutions, Inc., and Chief Shared Services Officer, Avenue Living Communities. “It’s clear the status quo is no longer an option.”

The real estate sector has a serious impact on the climate. The International Energy Agency (I.E.A.) estimates that buildings account for “one-third of global final energy consumption and 40 per cent of total direct and indirect carbon emissions.” And the energy consumption continues to increase as consumption of heating and air conditioning increases to keep buildings comfortable during extreme weather events.

Finding Potential in Older Buildings

But the real estate sector also has a great deal of potential to move toward sustainability. Retrofitting existing buildings to improve energy efficiency is part of the roadmap to sustainability laid out by the I.E.A. and the U.N. Global Alliance for Buildings and Construction, and it’s something we at Avenue Living have embraced.

Our portfolio focuses on class B and C buildings that are often overlooked by other investors, but which offer various advantages from an investment perspective. It turns out these advantages can also translate into environmental benefits, too. Older buildings of this type tend to be closer to employment and education hubs, reducing the need for long commutes by car. They tend to be in established neighbourhoods, which have infrastructure already in place and may allow residents to travel by foot or transit. And class B buildings are often well-maintained — retrofitting an existing building for energy efficiency generates far lower emissions and construction waste than a new build might.

“We’re continually examining our practices to find ways we can reduce our environmental footprint, from our day-to-day processes to the capital expenditures we make to our multi-residential assets,” says James.

That means reviewing everything from the cleaning products we use, to our sourced water, to the amount of waste we divert from landfills. Our capital expenditures have also included energy-efficient upgrades such as LED bulbs and low-flow showers, as well as a program to retrofit over 500 townhomes with new, more efficient furnaces.

Resident Experience Counts, Too

In making our buildings more sustainable, we’ve also made them more comfortable for our residents. The HVAC retrofits, for example, reduced energy consumption but also ensured temperatures were much more comfortable during the winter. The program has been such a success it will likely extend to other properties.

“We’re proud to enrich the lives of our residents and those of our neighbours, too, with programs and initiatives that help create sustainable communities, reduce environmental footprint, and hold us accountable to good governance,” says James.

That good governance has become even more vital during the COVID-19 pandemic, when Avenue Living needed to quickly adapt to new public health measures. “Keeping our residents safe has always been top of mind,” says James. New ESG practices include diligent cleaning, highly responsive support, and agile policies that can respond to changing circumstances. For example, during the initial lockdown in March 2020, Avenue Living implemented a program to help residents in isolation with daily errands, such as shopping or dog walking. We offered rent payment options to accommodate those receiving government support. And we have continued to advocate for our residents, ensuring they understand local tenancy acts.

We also work to foster community in other ways — when social distancing allows, we continue to show support for our residents through appreciation events or community renaming initiatives, which invite residents to participate in renaming newly acquired buildings.

Sustainability is a Win-Win

The result of our efforts has been manifold. We’ve been able to establish strong relationships with our preferred contractors, which allows us to be strategic with our capital investments. The results have benefitted our residents — with safe, comfortable, more energy-efficient homes — and have allowed us to maintain more stable occupancy at increased rents, generating more income.

“We’re embracing the shift to a sustainable economy by understanding how our actions have an impact on the communities around us,” says James. “After all, our investments create homes, which is why we believe in making our impact a positive one.”

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.avenuelivingam.com for additional information regarding forward-looking statements and certain risks associated with them.